Page 158 - 2025EBSlink

P. 158

Special Reports

ZIV Market Report:

Balance Returns to

Germany’s Bicycle Market

Text: Editorial Dept.

The German bike industry is This was especially true with the price of a non-electric bike, on the

at a crossroads. Once known rise of e-bikes and the strength of other hand, went up by 6.4% to

for steady, organic growth, the local service networks. $540 USD, which shows that the

sector saw an all-time high during lower end of the market is recov-

the pandemic years, but then the The amount of inventory ering and correcting itself.

market had a more sobering cor- should get back to normal in 2025,

rection afterward. At this point, and early signs suggest that cus- The German Bicycle Indus-

demand is returning to normal and tomers will remain interested in the try Association (ZIV) reports that

structural changes are taking hold. next season. Leaders in the field 3.85 million bikes and e-bikes were

The industry is recalibrating, not say that growth could begin again bought in 2024, which is only 2.5%

shrinking, but changing. in 2026 if the economy and gov- less than the previous year. Even

ernment policies work together. though sales went down, 53% of

The German bicycle indus- all sales were e-bikes, which shows

try spent 2024 adapting to new The average price of an how important they are in Ger-

circumstances following a period e-bike in stores went down by many for getting around.

of expansion during the pandem- 10.1%, to $2,860 USD from 2023,

ic. Due to excessive inventory, due to heavy discounting by re- Who are ZIV?

some sales decreased, prices were tailers in response to high stock

adjusted, and strategic adjust- pressure and an oversupplied mar- ZIV, a growing organization

ments were required. However, ket. Overall industry turnover fell representing the interests of the

there were signs that the market from $7.63 billion to $6.84 billion German and international bicycle

was strong below the surface. USD year-over-year, largely due industry, covers approximately

to this price pressure. The average

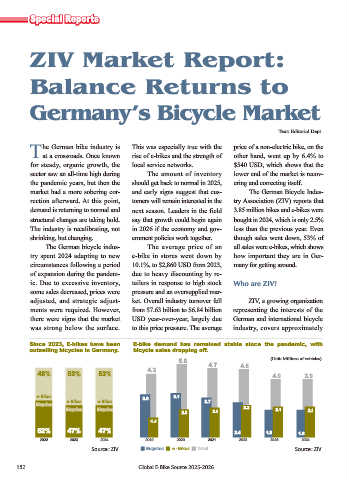

Since 2023, E-bikes have been E-bike demand has remained stable since the pandemic, with

outselling bicycles in Germany. bicycle sales dropping off.

48% 53% 53% 5.0 (Unit: Millions of vehicles)

4.7 4.6

4.3

4.0 3.9

H %LNHV H %LNHV H %LNHV 3.0 3.1 2.7 2.2

%LF\FOHV %LF\FOHV %LF\FOHV 1.4 2.0 2.0

2.4

2022 2.1 2.1

52% 47% 47% 2019 2020 2021 1.9 1.8

2023 2024

2022 2023 2024

6RXUFHƝ=,9

152 6RXUFHƝ=,9 %LF\FOHV 瀎 %LNHV 7RWDO

Global E-Bike Source 2025-2026